How are your Local Property Taxes Determined?

McGregor Property Taxes – City Hall Example

We do not need to be Tax Consultants to determine we are paying to much for the Government Services we are enjoying – [at every level of government]. In Texas, we pay Property Tax and not Personal Income Taxes. [Like it or not, that is the situation].

As Residents, we should all understand – who sets the Tax Rates and how do those RATES affect us as individual Taxpayers.

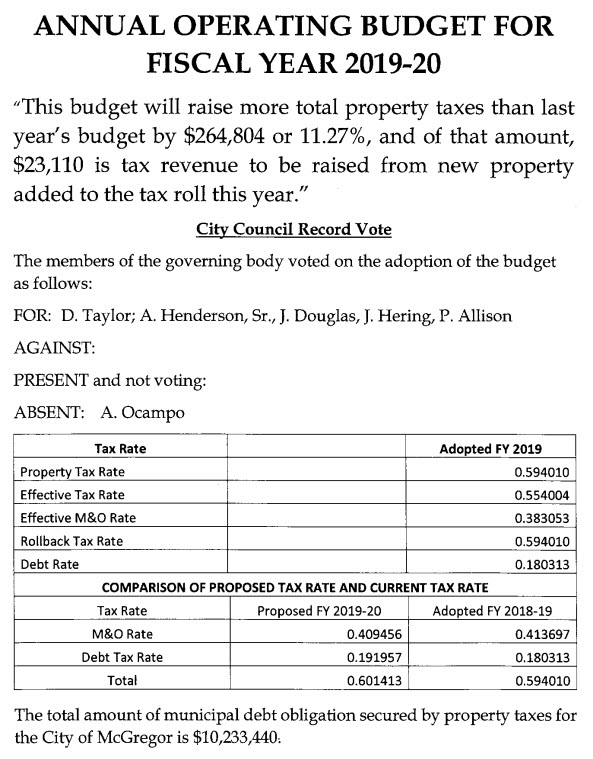

In McGregor, the City Council has that responsibility. The City is limited to a maximum of 8% increase in Property Taxes in any one year.

Every year [using the data our Group has access to] the City Council voted for the Minimum Property Tax Rate Increase – [every possible year]. We are suggesting our Group Members should understand some basic “formula math” to realize we need to decrease what we pay by decreasing the “Property Tax RATE:

Formula for Calculating YOUR Property Taxes |

||||||

|

(property tax amount) |

|

(RATE) |

|

(taxable value) |

|

|

$4,320.769339 |

= |

0.594010 |

x |

$727,390.00 |

/ |

100 |

Your Property “Taxable Value” – [is available from]:

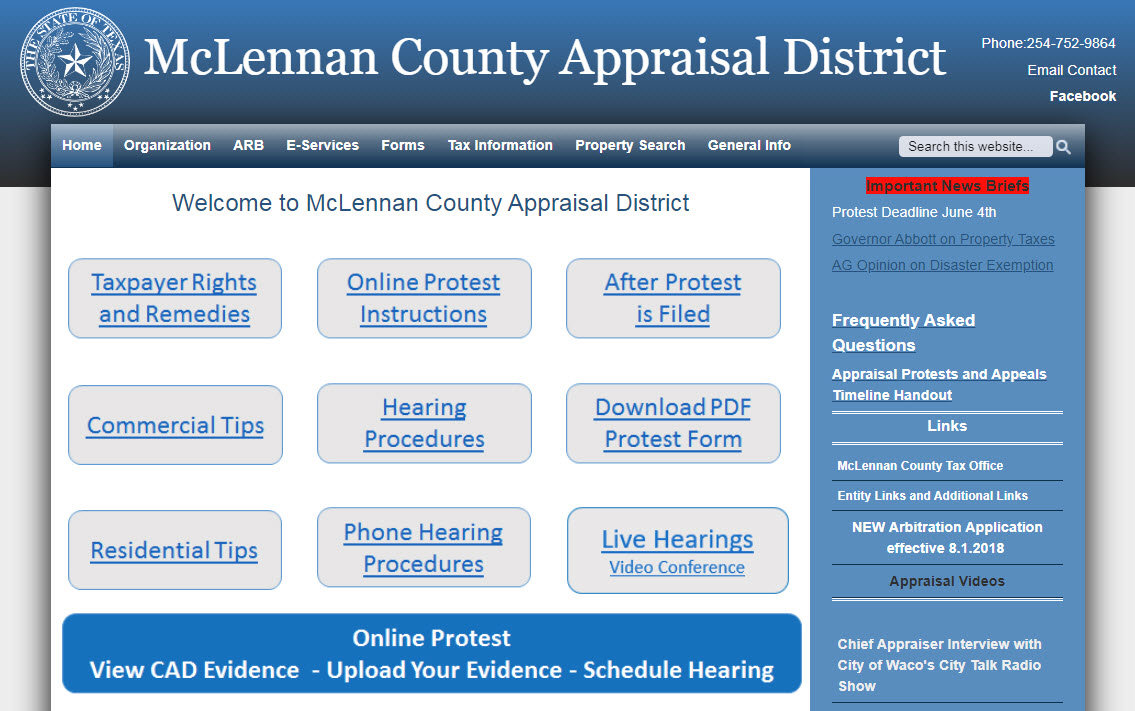

McLennan County Appraisal District

Your Property Tax “RATE” – [is available from]:

The City of McGregor

City Hall

302 S Madison St

McGregor, Texas 76657

PO Box 192

McGregor, Texas 76657

(254) 840-2806

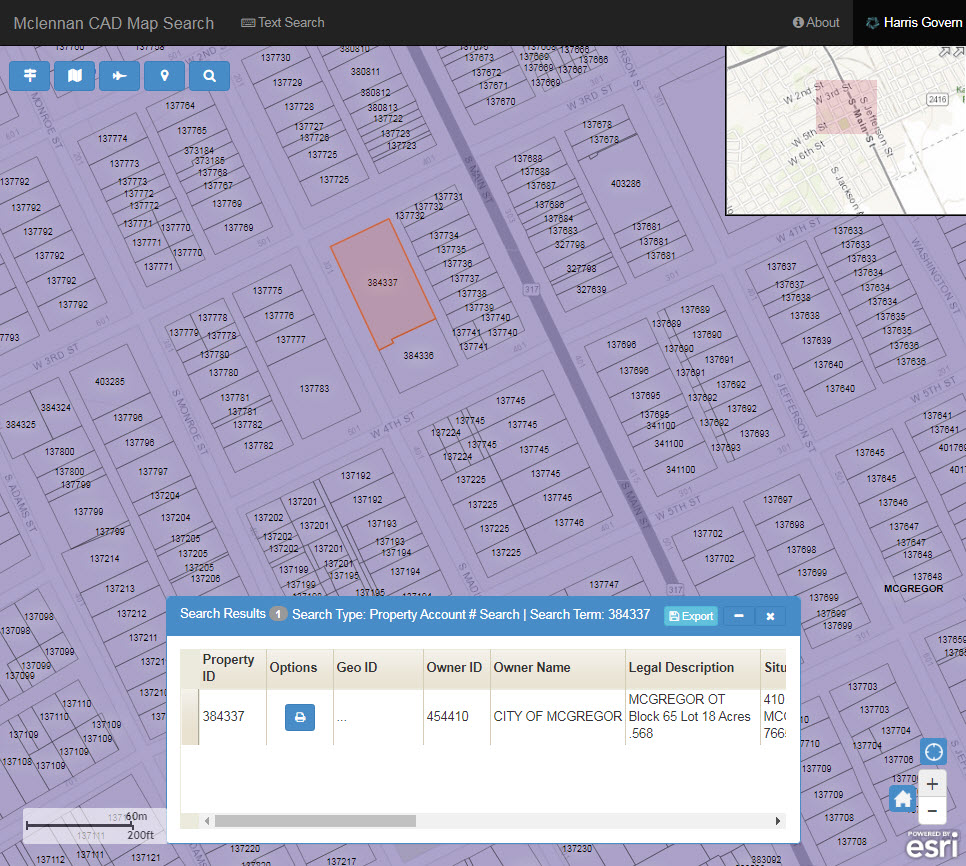

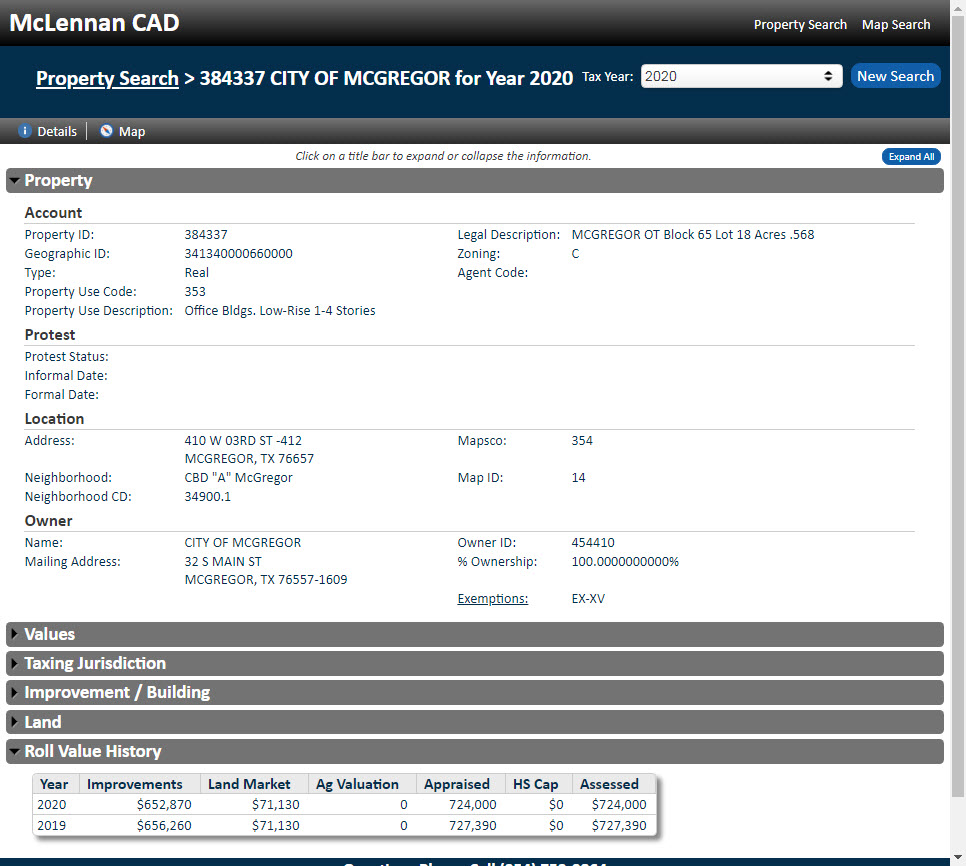

Example Property ID – 384337

www.mclennancad.org

2019 – [Determined by the McGregor City Council] – (rate) = 0.594010

City Hall

302 S Madison St

McGregor, Texas 76657

PO Box 192

McGregor, Texas 76657

(254) 840-2806

Example Property ID – 384337

(taxable value of the property) — $727,390.00

Taxable Value in 2019 for the City Hall “Example” is $727,390.00.

Important Property Tax Information

https://propaccess.trueautomation.com/mapSearch/?cid=20

https://propaccess.trueautomation.com/clientdb/Property.aspx?cid=20&prop_id=384337

https://cityofmcgregor.com/wp-content/uploads/MX-3570N_20200227_152637.pdf – Page 3/134

https://cityofmcgregor.com/city-government/agenda/

https://cityofmcgregor.com/wp-content/uploads/McGregor-City-ad-004.pdf

For more information please contact the City of McGregor:

Angelia Sloan – City Secretary — [254] 840-2806 — asloan@mcgregor-texas.com

City Manager – Kevin Evans – 254-840-2806 – kevans@mcgregor-texas.com

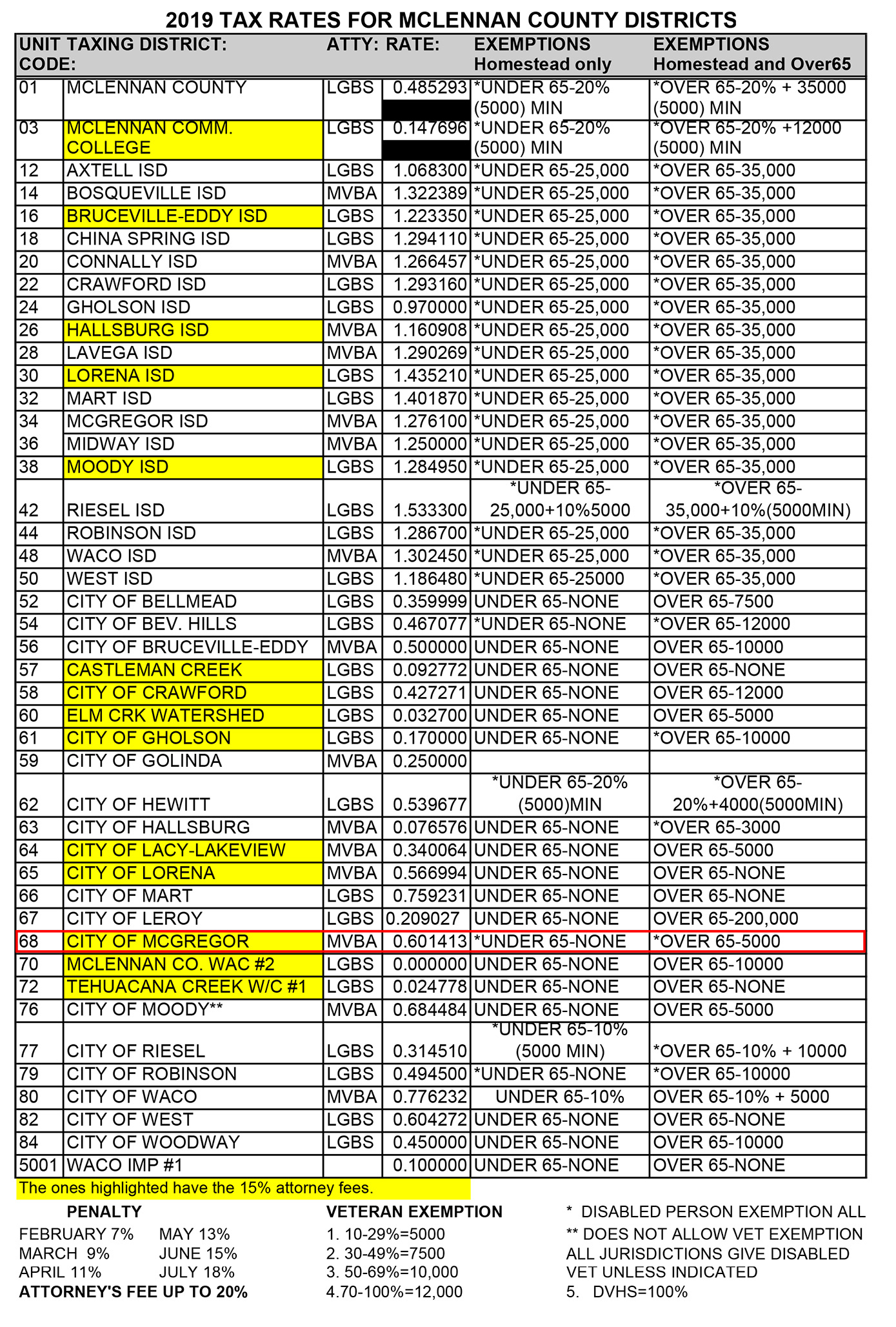

The document [below] from McLennan County lists the Tax Rates [by Districts] for the City of McGregor is 0.601413. Uncertain why the City 2019 Budget says 0.594010.